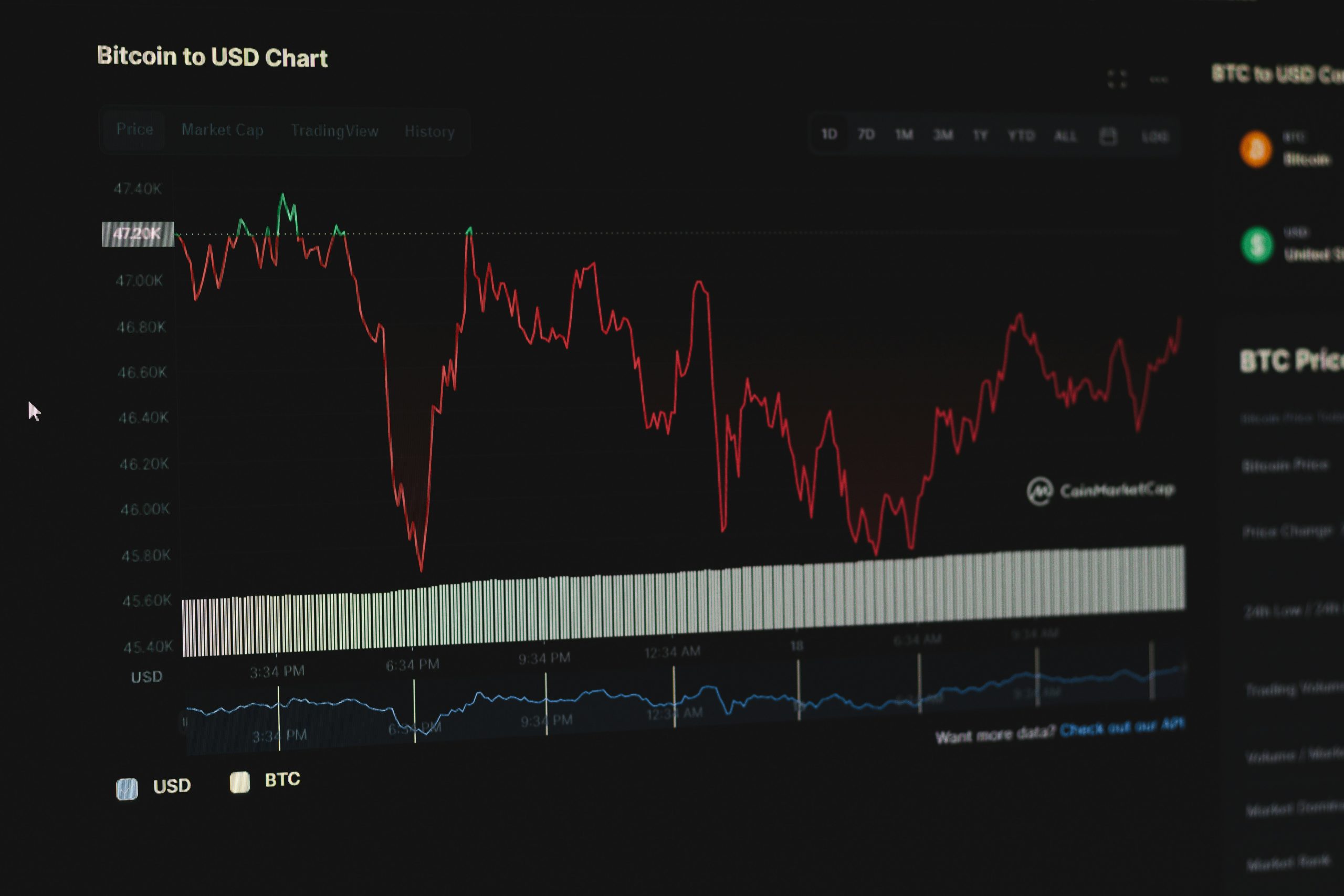

BTC down 5% in 24 hours as Trump nominates hawkish Fed chair, sparking crypto sell-off.

Bitcoin (BTC) has plunged to around $77,000, marking its lowest since April 2025 and entering bear territory with a 38% drop from all-time highs. Heavy liquidations and macro fears triggered the weekend rout, with CME futures opening at a massive $6,830 gap.

What Triggered the Sell-Off?

President Trump’s nomination of Kevin Warsh as Fed chair—seen as hawkish—reignited rate hike fears. Warsh replaces Jerome Powell in May, potentially tightening liquidity just as crypto needs it most. RSI below 50 confirms bearish momentum, with 200-week EMA heading to $58K.

Liquidations hit $1B+ over the weekend, wiping leveraged positions. Spot trading stayed active while CME closed, widening the gap.

Analyst Views

NS3.AI notes the prior bull run lacked momentum, suggesting a milder bear than 2022. Support at $75K holds for now, but break could target $55K realized price. Optimists point to institutional buying dips.

Broader Crypto Impact

Ethereum and altcoins followed BTC down 4-7%. Trump’s pro-crypto stance clashes with Fed pick, creating uncertainty. Watch Fed meetings for reversal signals.

Bitcoin’s resilience shines through cycles, but 2026 could test holders. Stay tuned.